Managing Risk to Avoid Supply-Chain Breakdown

By understanding the variety and interconnectedness of supply-chain risks, managers can tailor balanced, effective risk-reduction strategies for their companies.

On March 17, 2000, lightning hit a power line in Albuquerque, New Mexico. The strike caused a massive surge in the surrounding electrical grid, which in turn started a fire at a local plant owned by Royal Philips Electronics, N.V., damaging millions of microchips. Scandinavian mobile-phone manufacturer Nokia Corp., a major customer of the plant, almost immediately began switching its chip orders to other Philips plants, as well as to other Japanese and American suppliers. Thanks to its multiple-supplier strategy and responsiveness, Nokia’s production suffered little during the crisis.

In contrast, Telefon AB L.M. Ericsson, another mobile-phone customer of the Philips plant, employed a single-sourcing policy. As a result, when the Philips plant shut down after the fire, Ericsson had no other source of microchips, which disrupted production for months. Ultimately, Ericsson lost $400 million in sales.1 (Ericsson has since implemented new processes and tools for preventing such scenarios.2)

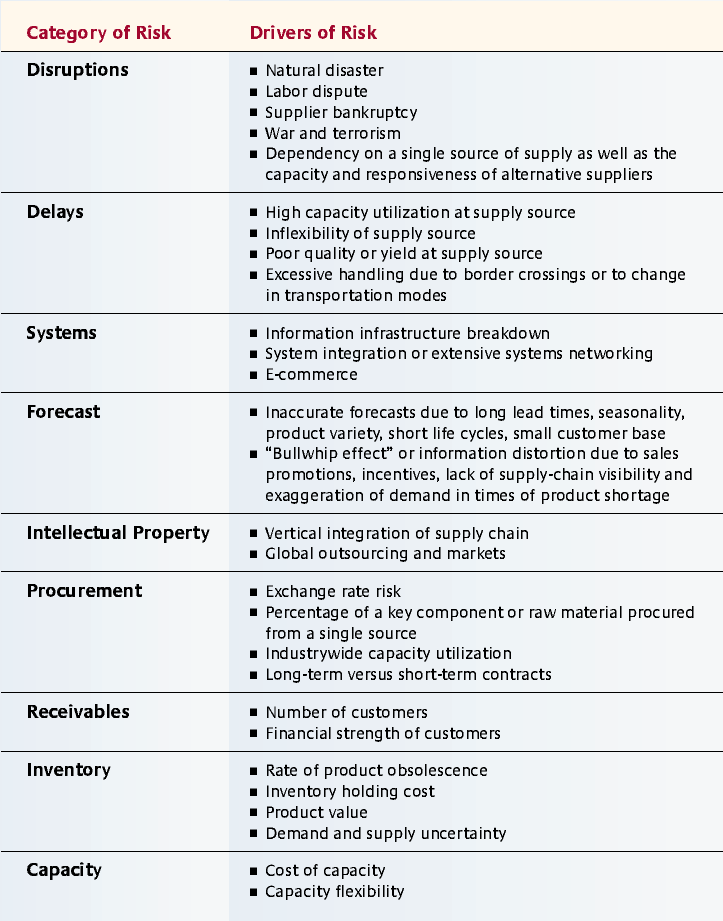

These two dramatically different outcomes from one event demonstrate the importance of proactively managing supply-chain risk. Supply-chain problems result from natural disasters, labor disputes, supplier bankruptcy, acts of war and terrorism, and other causes. They can seriously disrupt or delay material, information and cash flows, any of which can damage sales, increase costs — or both. Broadly categorized, potential supply-chain risks include delays, disruptions, forecast inaccuracies, systems breakdowns, intellectual property breaches, procurement failures, inventory problems and capacity issues. Each category has its own drivers (see “Supply-Chain Risks and Their Drivers.”) and mitigation strategies (see “Assessing the Impact of Various Mitigation Strategies.”).

References

1. R. Eglin, “Can Suppliers Bring Down Your Firm?” Sunday Times (London), Nov. 23, 2003, appointments sec., p. 6.

2. A. Norrman and U. Jansson, “Ericsson’s Proactive Supply Chain Risk Management Approach After a Serious Sub-Supplier Accident,” International Journal of Physical Distribution & Logistics Management 34, no. 5 (2004): 434–456.

3. K. Mishina, “Toyota Motor Manufacturing, U.S.A. Inc.,” Harvard Business School case no. 9-693-019 (Boston: Harvard Business School Publishing, Sept. 8, 1992).

4. M. Nakamoto, “Fire Hits Parts Supply Network at Toyota,” Financial Times, Feb. 4, 1997, p. 34.

5. B. Johns, “Damage to Chip Makers Puts Sourcing in Spotlight,” Journal of Commerce, Jan. 30, 1995, p. 1A.

6. A. Zimmerman, A. Merrick and O. Sook, “Retailers Scramble To Keep Stores Stocked,” Wall Street Journal, Oct. 21, 2002, sec. B, p. 1.

7. T. Lester, “Inside Track: Making It Safe To Rely on a Single Partner,” Financial Times, Apr. 1, 2002, p. 7.

8. M. Kane, “Inventory Controls Re-examined: Attacks Reveal Vulnerability of Just-in-Time,” Cleveland Plain Dealer, Oct. 29, 2001, sec. C, p. 4.

9. J. Kohler, “Prices Jump at Gasoline Pumps in the Area,” St. Louis Post-Dispatch, Aug. 29, 2001, sec. A, p. 1.

10. K. Maney and M.J. Zuckerman, “FBI Hunts ‘Love Bug’ Source: Damage From E-mail Source Cuts Across USA and Worldwide,” USA Today, May 5, 2000, sec. A, p. 1.

11. Basel Committee on Banking Supervision, “Sound Practices for the Management and Supervision of Operational Risk” (Basel, Switzerland: Basel Committee Publications, Feb. 2003), 1.

12. J. Gillis, “Backup Systems Passed Trying Test; Despite Scale of Destruction, Wall St. Data Largely Saved,” Washington Post, Sept. 27, 2001, sec. E, p. 1.

13. “Nokia Feels the Squeeze From Shortage,” Off the Record Research, Nov. 13, 2003.

14. H.L. Lee, V. Padmanabhan and S. Whang, “The Bullwhip Effect in Supply Chains,” Sloan Management Review 38 (spring 1997): 93–102.

15. “California May Have New Energy Deals,” New York Times, Aug. 8, 2002, sec. C, p. 12.

16. Author’s interview with Randy Pond, senior vice president, Cisco Systems Inc., Nov. 2002.

17. C.L. Hays, “Sears Earnings Will Be Hurt by Credit Unit,” New York Times, Oct. 18, 2002, sec. C, p. 1.

18. J.L. Heskett and S. Signorelli, Benetton (A), Harvard Business School case no.9-685-014 (Boston: Harvard Business School Publishing, 1989).

19. K. Mishina, “Toyota Motor Manufacturing, U.S.A. Inc.,” 4–5.

20. See the newsvendor problem in S. Chopra and P. Miendl, “Supply-Chain Management: Strategy, Planning, and Operations,” 2nd ed., (Upper Saddle River, New Jersey, Prentice-Hall, 2003), 346–352.

21. J.L. Heskett and S. Signorelli, Benetton (A), Harvard Business School case no. 9-685-014 (Boston: Harvard Business School Publishing, 1984).

Comment (1)

ANSHUMAN KHARE