Five Steps to a Dot-Com Strategy: How To Find Your Footing on the Web

“The Internet changes everything.” Although this might have been an overstatement just two years ago, it is clearly not so today. The impact of the Internet is obvious in business-to-consumer transactions: witness the proliferation of Web sites for facilitating sales and services across a broad range of offerings. But the real revolution is happening in business-to-business value chains as companies restructure their operations with trading partners.

The Internet also has had a profound impact on the valuation of individual companies and economic sectors. This can be seen not simply in the incredible market capitalization of companies whose business models are rooted in the Internet (e.g., Amazon, eBay, Yahoo!, Priceline), but also of companies that provide the technical infrastructure for the Net economy (e.g., Intel, Microsoft, AOL, IBM, Cisco). Such valuations—although highly volatile—are compelling established companies to seriously assess whether they will lose out to relative upstarts that are leveraging their lofty valuations into tangible capabilities through acquisition.

The Internet has also evolved beyond personal computers; soon it will be commonplace to access the Net through cellular telephones (Nokia, Ericsson), personal organizers (Palm Computing, Psion), videogame consoles (Sega’s Dreamcast or Sony’s PlayStation), as well as home appliances (Electrolux, Whirlpool), vending machines (Maytag), and automobiles (GM’s Onstar and Microsoft’s AutoPC). In short, the Internet has become more than a simple and effective way to exchange e-mail and documents; it is emerging as a critical backbone of commerce. And, it is happening at a faster pace than many thought possible1 and with which few feel comfortable.

But, if you ask managers about the strategies for their Internet businesses, you get a bewildering array of responses. Some mention the functionality of the Web (“you can get the details of our latest new product introductions”); some highlight their choice of platform (“we are driven on the Oracle platform or IBM’s e-business infrastructure or Hewlett-Packard’s latest suite of e-services”). Some trumpet how they use the Web to enhance customer service (“we provide enhanced customized service—such as specialized pricing and promotions or provide rapid response to customer inquiries”), whereas others point to their success in integrating the physical and digital infrastructures to provide seamless service (“our customers can interact with us in branches, by telephone, or over the Net without any differences in cost or service levels”). Some mention their initial success in creating customer communities (“we now have a regular and continuous dialogue with our customers and this has helped our marketing efforts considerably”). These different observations simply underscore an important characteristic of the Net; its potential functionality is so broad and varied that we cannot and should not restrict our attention to a few narrow domains. Indeed, it is like the proverbial blind men describing the elephant: Different managers see different facets of benefits but do not see the complete picture. Although most managers are cognizant of impending changes, the business landscape is fuzzy and fast-changing. We are navigating in uncharted waters.

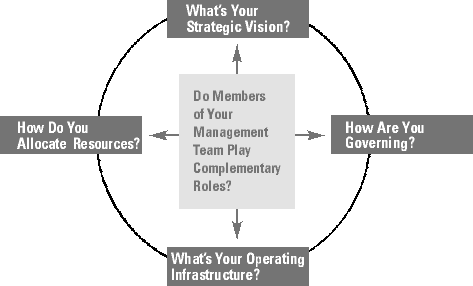

How should companies develop effective strategies in such a situation? Four interrelated issues are useful in orchestrating conversations about the dot-com agenda. Effective strategizing for the dot-com business operation requires the management team to consider these issues together, not in isolation. Too often, companies focus on one dominant issue and let it be the driving force while paying scant attention to the other issues only to realize the ramifications and conflicts much later. The four issues and the fifth alignment challenge can be posed as questions:

- What’s your strategic vision for the dot-com operations?

- How do you govern the dot-com operations?

- How do you allocate key resources for the dot-com operations?

- What’s your operating infrastructure for the dot-com operations?

- Is your management team aligned for the dot-com agenda?

Consistent answers to these five questions indicate an effective strategy for the dot-com business operations.

1. What’s Your Strategic Vision for the Dot-Com Operations?

Even as recent as early 1998, most companies saw the Net as being only tangentially relevant to their business operations. Today, they realize the possibilities and opportunities but are daunted by the challenge of how to make the Internet and e-commerce an integral part of their business strategy rather than a standalone project.

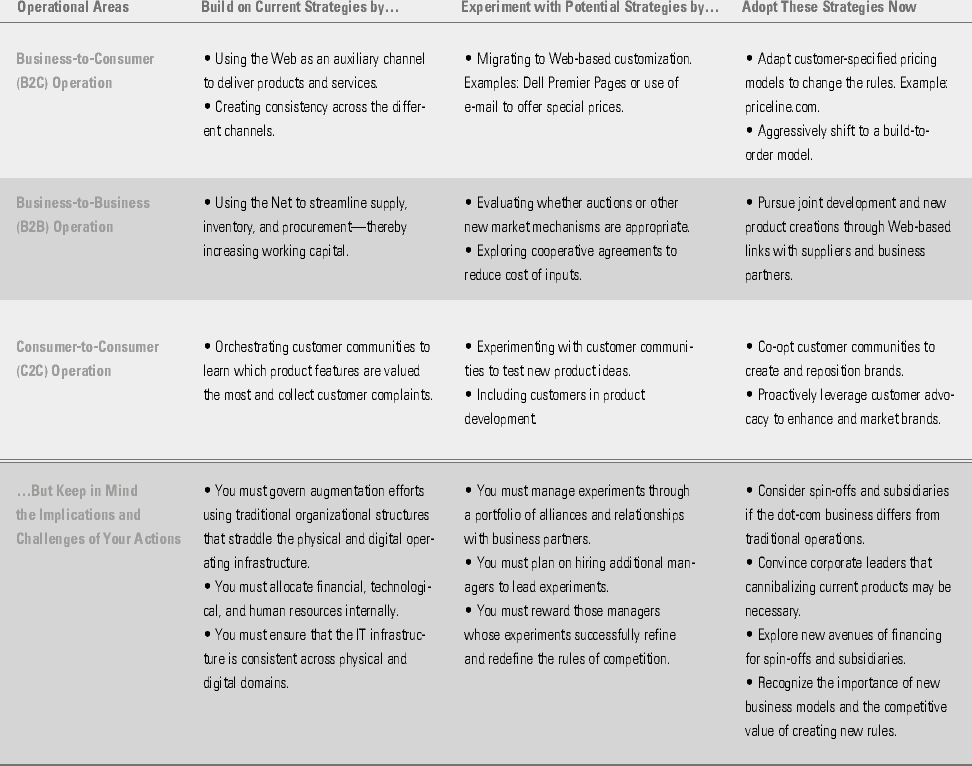

Articulating a strategic vision for dot-com business in precise terms is futile; the Net is evolving at such a dizzying pace that it’s nearly impossible to work towards a specific end-state. It’s more useful to approach the issue of strategic vision for dot-com operations as a continuous cycle involving building on current business models and creating future business models through selective experimentation. The aim is to balance refining the current business rules while creating new business rules for the dot-com agenda.

Build on Your Current Business Models

For every corporation, the Net—at minimum—offers opportunities for reducing operating cost levels and/or enhancing services. Every company should identify ways to leverage the Net for restructuring the cost base. Even companies that don’t find their business-to-customer interactions easily portable to the Net could find value in business-to-business transactions through restructured supply chains.

Cost Leadership.

Strategy has always relied on cost differentials2 and the Net does not negate this fundamental strategy axiom. Indeed, the Net exposes the inherent weaknesses of high-cost competitors—whether they are big or small. Jack Welch, the legendary chairman of GE, has already sponsored a 90-day, all-company initiative under the banner of “destroyourbusiness.com” for thinking about how to use the Web to eliminate bureaucracy. In every conceivable case, the cost of Web-based transactions is an order-of-magnitude lower than traditional ways and decreasing at a faster rate. The cost of an Internet-based banking transaction is about one-fiftieth of the cost of a human teller transaction. New breed stockbrokers like E*TRADE and Ameritrade have inherently lower cost levels and are forcing traditional players, such as Merrill Lynch, Schwab, and Fidelity, to dramatically lower their price points. We will see more such cost-based competitive pressures in many other sectors of the economy.

The centrality of cost leadership in the dot-com arena can be best seen in the personal computer marketplace—where net-savvy customers look for the best value, and the stock market ruthlessly punishes high-cost operators with lower capitalization. Dell has consolidated its market superiority by migrating its build-to-order model to the Web3—forcing companies like Compaq, NEC, Sony, and Toshiba to radically restructure their operations to avoid being left behind. Cost leadership is also relevant in other markets—automobiles (with the introduction of autobytel.com, Microsoft’s carpoint.msn.com, and autoweb.com), electronic goods (gigabuys.com), toys (etoys.com), and others. The two major online travel agencies (Travelocity and Preview Travel) have recently merged to further consolidate their operations and reduce the cost of online bookings. Web-supported, low-cost airlines are springing up in Europe (easyjet.com). Companies not pursuing cost-based advantages through the Web will be left behind in the massive sea change under way.

Enhancing Services.

The dot-com operations allow for enhanced services. We have come a long way since FedEx introduced us to the possibilities of tracking packages over the Net. Today, customers expect logistics companies to make their inventory chain visible. Placing content on Web sites is a powerful differentiator: Customers can now get critical information at their convenience. Indeed, customers expect timely updates (delivery schedules, product updates, account information), product enhancements (patches for software glitches), rapid resolution of problems not found in the FAQ list (through e-mail and remote-monitoring capabilities), as well as personalized interactions through customized navigation paths on company Web sites (see, for instance, Dell, GM, and Toyota).

American Airlines’ new AAlert e-mail service tells specific customers when their chosen destinations or departures are featured in special deals. Other airlines are scrambling to provide similar service features. Cellular phone customers can modify, adapt, and upgrade ringing tones (nokia.com), and consumers can see breaking news footage at their own convenience (cnn.com, bbc.co.uk).4 Companies will further enhance personalized service as more and more devices are connected to the Net.5 Next-generation home appliances such as refrigerators, washing machines, and microwave ovens will be connected to the Net as homes become wired and smarter.6

Create New Business Models

The power of the Web lies in the creation of new business models. It has become fashionable to talk of “new business models” when discussing the Net—this phrase has emerged as a catchall way to highlight the impact of the dot-com operations. We do need to be more precise: New business models are those that “offer, on a sustained basis, an order-of-magnitude increase in value propositions to the customers compared to companies with traditional business models.” In doing so, these new models disturb the status quo and create new rules of business. Traditional companies cannot easily match the value propositions offered by these new business models without substantially altering their margin structures. They also find it difficult to go beyond incrementally refining the current rules to create radically different rules. However, an important part of the strategic thinking for every company is to develop scenarios of new business models—even though they might challenge the status quo and cannibalize current revenue and margin streams.

Look at the music marketplace: The big four—Universal, BMG, Warner EMI, and Sony—now control about 80% of industry sales, and online distribution accounts for about 1% of sales, representing the sale of CDs by mail order. But the availability and increased acceptance of music players that use the mp3 format (mp3.com) are likely to create major disruptions in the economic landscape. As more Internet sites (Amazon recently entered the fray) support the downloading of music onto mp3-compatible devices (see, for example, the Rio player, at rio.com), every major record label needs to rethink its business models. Featuring more than 25,000 performers affiliated with over 100 independent labels, mp3.com enjoys a market capitalization of over $2 billion and has been legitimized by Sony’s decision to make a version of its popular Walkman that will play music in the mp3 format. The major labels are already responding with their own aggressive plans, which include abandoning traditional music formats. It is a far cry from listening to vinyl records on turntables!

The music marketplace is not an exception. The retail financial services industry is changing with multiple players from historically disparate segments jockeying to create new business models. Priceline.com is revolutionizing travel and related services by letting customers specify their desired prices and serving as a mechanism for competing companies to bid for customer requirements. It started with airline tickets and has since expanded to cover hotel rooms, home financing, and new car purchases and leases. Their model of “buyer-driven commerce” is supported by a string of patents and could prove to be a powerful new business model. Amazon is more than an electronic bookseller. New market mechanisms that incorporate auctions (see, for example, freemarkets.com) are beginning to challenge industrial companies. New electronic aggregators are also emerging in many areas such as steel (e-steel.com) to reduce inefficiency and redistribute value. Indeed, one is hard-pressed to think of markets that may be unaffected by the Net. We clearly have not reached a steady state, and it is unclear whether we ever will.

Experiment with Scenarios

So, what should companies do? We need to abandon calendar-driven models of strategy perfected under predictable conditions of the Industrial Age. We should embrace the philosophy of experimentation since the shape of the future business models is not obvious. The strategic challenge is to spearhead experiments7 to assess probable future states and migrate operations to the desired state. Establishing the vision and rationale for these experiments—including the mandate to proactively cannibalize current business models—is a critical hallmark of leadership for the dot-com world.

Coordinated experimentation is required to develop the building blocks for success in the dot-com arena. Leading consumer-product companies are now assessing the strength of brand equity and brand pull in the Web world. Having established a credible brand franchise in the physical space, Gap is now experimenting with gaponline.com. But will it translate well on the Web? Somewhat unconnected with Procter and Gamble’s major brand names, the company has unleashed a new unit to create custom-designed cosmetics (reflect.com) along the lines of Dell’s build-to-order approach. Nike—a brand leadership phenomenon of the late twentieth century—is trying to create consumer pull through custom-designed shoes (www.nike.com/id) and through its strategic alliance with fogdog.com—an online sports gear retailer. Unilever, Kraft Foods, P&G, and other global consumer-products companies are also seeking to port their operations to the Net.

Experimentation is not limited to rethinking brand equity. Look at retailing—a market that has seen major disruptions caused by Internet versions of category killers. Current leaders in the traditional marketplace are experimenting with ways to defend their market positions while adapting their strategies for the Web (see, for instance, toysrus.com, walmart.com, nordstrom.com, and sears.com.) Even top-line niche players like Tiffany’s and Harrods are experimenting to identify the best possible ways to migrate their operations to the dot-com world without diluting their brand image.

Publishing is much the same—likely to be significantly reshaped by the Net, even though dominant new business models with assured profitability have yet to emerge. Today, we have the dot-com add-ons to paper-based publications (see, for example, fortune.com, businessweek.com, ft.com). Experiments to assess the likelihood of revenue generation from online publication (such as The Wall Street Journal interactive edition, wsj.com) are under way with no conclusive results; yet, the publishing industry cannot afford to neglect the Net. These experiments require more than merely porting their print content to the Web; they involve rethinking the distribution of content as well as restructuring relationships to integrate content from multiple sources.

In television and broadcasting, NBC is leading the way beyond conventional broadcasting and has already created a portfolio of experiments. Witness msnbc.com, its partnership with Microsoft to combine cable and the Internet. It has also created nbc.launch.com to focus on music, and has recently combined all of its activities under NBC Internet, to coordinate its Web experiments. CNN.com is partnering with WebMD to become a health-information portal for its customers (www.cnn.com/health). Indeed, all leading television networks are experimenting with different ways to incorporate the Web as part of their strategy.

Selective strategic experimentation is the sine qua non of strategy formation8 for the dot-com world. However, a major danger is that these experiments could be seen as standalone tangential projects decoupled from the mainstream operations. It is important that they be seen as building blocks for migrating and transforming the corporation to the dot-com world. Strategic experiments—when properly conceived and executed—can reveal powerful new ways to succeed in the dot-com world, where history offers little guidance.

The Bottom Line: A business strategy that fails to recognize the Net is destined to fail. Past success is no guarantee of future success, and calendar-driven strategic planning is giving way to strategic experimentation and rapid adaptation. The challenge is to pursue experiments that not only augment current business models but also create new business models and rules of competition.

2. How To Govern the Dot-Com Business?

The challenge of how best to govern the dot-com operations is daunting. Managers must attract and retain key management talent; they are intrigued by the differential market valuation of dot-com operations and are struggling with the requirement to give adequate management time and attention to the dot-com strategy and operations. At the same time, they find that the dot-com operations differ from their traditional operations and find it difficult to reconcile them.

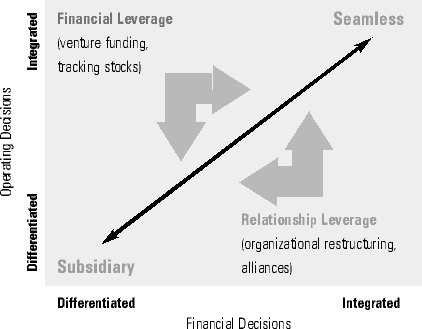

Two major categories of decision influence the governance mode: operational decisions (production, sourcing, logistics, marketing, and human resources) and financial decisions (investment logic, funding sources, and performance criteria). The governance of dot-com business is best seen as a trade-off between these two categories: how firms differentiate and integrate operational and financial decisions. The basic governance choices can be arrayed along the diagonal as a continuum from subsidiary (spinoff) at one end and seamless (transparent) at the other end.

Decoupling Your Dot-Com Operations and Finances

When faced with the fast-paced changes unleashed by the Net, managers may benefit from differentiating the operations and decoupling the financial arrangements. Take the case of Nordstrom.com—the newly created subsidiary of Nordstrom formed to accelerate the growth of its Internet and catalog direct sales but with minority funding from Benchmark Capital. The new subsidiary—Nordstromshoes.com—is aimed at selling leading brands of shoes. The funding from the venture capital community allowed the subsidiary to invest in site development and to create the appropriate software as well as a distinct advertising campaign—without being handicapped by the requirements of using only internally generated resources. In a related vein, Wal-Mart.com is being contemplated as a separate company with funding from Accel Partners.9

This governance mode makes sense under the following conditions: (1) the company is willing to explore new business models apart from the constraints of current operations; (2) the subsidiary or spin-off can be created without being constrained by current technology and legacy operations; and (3) the company bestows the subsidiary with the freedom to form alliances, raise capital, and attract new talent.

Morphing Old Practices into New Ones

Now let us look at the other end of the continuum—where operational and financial decisions of the dot-com operations are intermingled with the traditional business domain. In some cases, differentiation of the dot-com operations may be inappropriate, because it could dilute the level of management attention needed to ensure success. The dot-com operations are seamlessly integrated as the traditional company morphs to become the dot-com company. Take a look at Encyclopedia Britannica (eb.com): It was an undisputed leader in its category, experimented with CD-ROM, and has finally evolved into a dot-com operation by making its content available free on the Net.

Cisco is a dot-com company whose operations cannot be segregated into dot-com and non-dot-com components. As CEO John Chambers observed: “In 1998, Cisco is the best example of a company using the Internet technology to gain a sustainable competitive advantage with over 70% of customer inquiries handled online and 64% of orders placed via the Web.”10 Cisco may be leading the pack, but it is by no means alone. Intel is a dot-com company with more than 40% of sales conducted through the Net. As Intel Chairman Andy Grove remarked: “In January 1998, the company had exactly zero customers on line. Phones, faxes, and overnight parcel carriers served as the conduits for placing orders. By June 1999, over 560 companies in 46 countries were using Intel’s Web-based order-management system to place orders, track deliveries, post inquiries, and get product and pricing updates. Today, this system produces nearly $1 billion in sales per month.”11

This seamless governance mode makes sense under the following conditions:

- There is no meaningful way to separate digital and physical operations without creating confusion in the minds of customers.

- Senior management is committed to embracing the opportunities and challenges of the Net to redefine the value proposition as well as aggressively react to competitive moves.

- The entire organization can be mobilized to migrate to the dot-com world (as Egghead Software did when it abandoned its physical presence in the retail software market to migrate to the digital world with egghead.com).

Finding Your Place on the Governance Continuum

Different companies rightfully choose different governance models depending on their views of the centrality of the dot-com operations. Lloyds TSB, the United Kingdom’s largest bank, has decided to keep its dot-com operations integrated—for the moment—but with a different brand identity. In contrast, Bank One, a leading U.S. retail bank, with its Wingspan bank and Halifax with its Greenfield.co.uk established their dot-com operations as separate subsidiaries. Governing in the dot-com world depends on a dynamic interplay between the two decisions on this continuum. It can be understood through two transition paths: One is to leverage financial instruments and the discipline of financial markets, whereas the other is to restructure relationships—both internally and with alliances and partnerships.

The financial leverage transition path allows companies to exploit two popular mechanisms: (1) issuing separate stock through an initial public offering (IPO) of the dot-com operations and (2) infusion of external venture capital funds. Dixon’s in the United Kingdom floated 20% of its Freeserve Internet Service Provider (ISP) operations as a separate stock (ticker: FREE), which had, at its peak, a market capitalization of about $8 billion. Prudential, the UK life insurance company, is in the initial stages of floating its Internet-only banking operations. Playboy Entertainment plans to tap the financial market for its dot-com operations. Microsoft, the market capitalization leader, has spun off its Expedia Internet travel business as a separate company (ticker: EXPE). In the words of Brad Chase, senior vice president of Microsoft’s consumer and commerce group, the IPO would allow the business “to use its resources to partner with other people, to buy other Web sites, and grow its vertical marketplace.”12 NBC Internet is a separate trading stock (ticker: NBCI) with a market capitalization of more than $4 billion. These initiatives reflect an important strategic consideration: the financial markets bring external discipline to governance that is critical under fast-changing conditions.13

An alternative to the use of tracking stocks is to pursue private placement through venture capitalists. Venture capitalists such as Kleiner Perkins and Benchmark Capital are aggressively working with traditional companies that are developing dot-com operations; their aim is to unleash hidden value in those assets that may not have been properly governed—and, hence, are inadequately valued. This is an interim position before taking the dot-com operations public. Indeed, the question of whether to infuse external venture capital to spearhead the dot-com operations is a key strategic issue facing every company today.

The relationship leverage transition path focuses on organizational arrangements to bring the governance issue into sharper focus. When General Motors created a separate division, e-GM, it signaled a major commitment to the Internet as a future business platform. This unit is responsible for coordinating all the dot-com initiatives, including its OnStar initiative, to establish the individual car, itself, as a portal. It is testing the shape and scope of this e-franchise and the role of retailers in the revamped value chain of the dot-com world. GM’s Vauxhall division in the United Kingdom, a major initiative of e-GM, is perhaps the first automotive company to announce a set of six models for sale only on the Web.

To consolidate its Internet initiatives, Kraft Foods has created a separate organizational unit, which is one step short of a subsidiary, because Kraft does not radically separate the financial decisions. It provides an organizational context to question possible areas of cannibalization, as well as to coordinate multiple experiments taking place in the dot-com arena. Raising the organizational level of attention to the dot-com operations is an essential step in crafting a coherent strategy, because multiple conflicting decisions must be coordinated across traditional and dot-com spaces.

The transition to the dot-com world is not limited to internal restructuring, but also involves alliances and partnerships. Ford Motor Corporation is exploring the potential of the Internet in its marketing activities in partnership with Microsoft. Sotheby’s is jumpstarting its dot-com operations by forming an alliance with Amazon.com to expand its auctions business beyond its traditional high-end collectibles (see sothebys.amazon.com).

Clearly, these two transition paths are complementary ways to position along the governance continuum; this is not a static decision since a mode of governance is only appropriate for a given context, and the context is fast-changing in the Internet world. Recognizing the complementary roles of both financial and organizational instruments in this dot-com world is key. We may see Disney spinning off its Buena Vista subsidiary, we may see the Ford-Microsoft relationship evolve into a separate business primed for IPO, and we may see Walmart.com as a separate stock. Clearly, the governance of the dot-com operations for every corporation is a critical management issue that could either unleash or constrain the hidden value of core assets in this time of profound transformation.

The Bottom Line: More than understanding the potential challenges and opportunities posed by the Net, the biggest stumbling block for an effective strategy will be lack of adequate attention to the governance issue. In Internet time, mistimed and ill-prepared strategic moves can be costly. Pursue financial and relational leverage paths to continually fine-tune the governance position along the continuum between subsidiary (spin-off) and seamless (transparent) modes.

3. How Do You Allocate Resources for the Dot-Com Business?

Closely related to governance is the allocation of resources: how best to assemble and deploy the key resources for succeeding in the dot-com world. One manager in a major corporation remarked that “…the dot-com operations is a war for talent; it is a war for three types of resources—human, technological, and financial.” It is a war because traditional companies need these critical resources to migrate their operations to the Net, and new entrants seeking to establish their superiority in the new world also need them. The new Internet startups are attracting young talent away from established industries—witness the profile of recent graduating classes in top universities joining Silicon Valley startups, and look at the roster of corporate big names joining Internet startups. Startups enjoy an edge over traditional companies. They are leveraging their newly established wealth to acquire resources that the traditional companies find it difficult to match.

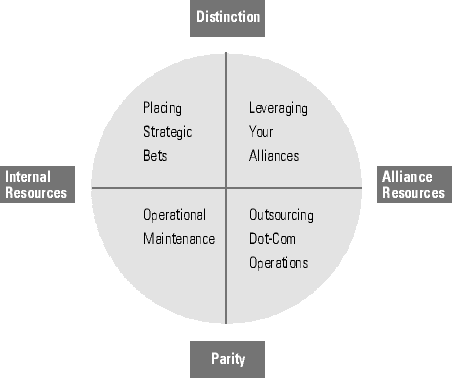

Four different but interlinked approaches are required for assembling and deploying the required resources.

Placing Strategic Bets

Here the company commits internal resources to differentiate its dot-com operations from those of competitors. These resources may be financial, technological, or human. Bank One has publicly indicated that its growth in traditional areas will be marginal and has redirected its resources to dominating the online world (bancone.com). Electrolux is betting that it can control the kitchen network in the era of networked kitchens. John Deere is pursuing precision farming so that operators who are using tractors connected to the network receive real-time guidance on services. Nike is betting on selling customized shoes through the Net, and Maytag wants to establish superiority in Net-enabled vending machines. The leaders in the traditional world, such as GE, NBC, CNN, Pearson, Wal-Mart, SKF, Citicorp, and Kraft Foods, are making significant strategic bets in dot-com experiments.

From a human-resource point of view, the real challenge is to stem the impending brain drain away from the traditional established companies towards the dot-com startups. A former Wal-Mart senior officer now runs Amazon.com’s logistics. George Shaheen of Andersen Consulting now runs WebVan. Companies such as GE, IBM, and British Telecom have lost senior managers to Web startups. What are the key human resources required to run the dot-com operations, and what changes in incentives are required to make this happen? Articulating these strategic bets is absolutely critical.

Strategic bets should be placed on a set of probable opportunities instead of predictable ones. When investments in the dot-com world are viewed as real options, companies can potentially invest in a broader range of opportunities than otherwise.14 Instead of fully funding a smaller set of relatively predictable projects, the aim should be to acquire a set of options with rights to acquire and leverage certain capabilities, should they prove successful.

Learning How to Leverage Your Alliances

Differentiated capabilities can be created through alliances and partnerships. The dot-com operations are by definition networked and call for assembling complementary strategic capabilities through relationships. Pearson, the United Kingdom’s media giant, is forming a strategic relationship with AOL, and its importance is signaled by the fact that Pearson’s CEO now sits on the AOL board. Yahoo’s success is based on its portfolio of alliances. Microsoft is a master at exploring multiple avenues for acquiring resources—through mechanisms such as equity investments, cross-licensing, joint development, and ventures. More than ever before, it is the pattern of strategic alliances and relationships that indicates strategic strengths in the dot-com world. These alliances are not limited to the players in the physical world linking up with dot-com players. Even first-generation dot-com companies such as Amazon, Priceline, and eBay are steadily evolving and refining their alliance structures to redefine their business models. Amazon’s equity investment in drugstore.com is another case in point. A new breed of firms like Viant (viant.com) actively collaborates to build digital businesses for companies such as American Express, BankBoston, Compaq, Radio Shack, and Kinko’s.

These alliances will reflect more joint profit sharing rather than fee-for-service. For instance, Sony is working with EDS to create, design, and build the Metreon entertainment center Web site (metreon.com), one of Sony’s dot-com initiatives, and EDS will receive a share of the revenues. We will see more alliances—with risk-reward sharing—for accessing and deploying resources in the dot-com world. Consulting companies that are building digital businesses will move away from fee-for-service toward equities and risk-reward sharing. This trend will continue at a faster pace.

The dot-com operations are network-centric. Hence, they call for strategic approaches that are not anchored on resources inside the firm but fundamentally involve resources acquired and leveraged in a network of relationships. They call for strategies to be seen as a “portfolio of capabilities that are acquired and deployed through a portfolio of relationships.” This is a far cry from strategy seen as primarily resource deployments inside the firm. Positioning and navigating in a complex network of resources is a hallmark of differentiation for companies like Amazon, Yahoo, AOL, and Microsoft.

Outsourcing Dot-Com Operations and Maintaining Operational Parity

These are areas of the dot-com operations in which activities like Web hosting, back-end processing, and order fulfillment can be conducted outside the firm. More than in the traditional world, dot-com operations (by virtue of their networked infrastructure) allow for complementary players to be easily linked. Companies increasingly find it easier to rely on standard services from established players like IBM, HP, Oracle, Microsoft, EDS, and AT&T so that they can build their operations on a robust and stable platform. Given the rate of change in technology and the impressive cost-performance shifts, it is more important to rely on best-in-class providers rather than create these operations inside.

Whether or not you outsource, your IT support operations must achieve competitive parity. Resources should be allocated on the basis of predictable models and supported by techniques such as activity-based costing. The aim is to ruthlessly achieve the lowest operating costs for the required level of functionality, as well as to evaluate possible risks and rewards of outsourcing.

The Bottom Line: Effective strategies for the dot-com world are based on the pattern and timing of resource deployment. The overall logic of resource allocation for the dot-com is different from the predictable models of the physical world. Assemble resources from multiple sources and manage them on a dynamic basis.

4. What’s the Operating Infrastructure of Your Dot-Com Business?

The next major requirement is to design the operating infrastructure. It is tempting to describe its technical characteristics by saying that “we are wired” or “we are net-enabled” or “we are digitized.” More importantly, we need to understand the characteristics of the infrastructure that provide value for customers—the features that draw customers to the dot-com world and encourage them to continue to use the Net as a primary way of using products and services.

The first wave of the Internet was about the number of computers connected to the Net—which ushered in the network economy.15 The second wave is about relationships and business models that leverage the key characteristics of the network economy.16 These business models straddle the traditional and dot-com spaces for delivering superior customer value propositions. Hence, the infrastructure could either support the strategy or fail. It is useful to look at the operating infrastructure as four building blocks that reflect an integrated physical-digital platform.

Attaining Superior Functionality

Do customers find their online experience supported by the appropriate functionality? Better quality images, audio clips, and 3-D rendering have enhanced the power of the Web to be realistic. (See Web sites using the functionality offered by Real Networks—realnetworks.com—or Macromedia—macromedia.com.) Take, for instance, the sale of a Gulfstream corporate jet for about $23 million: Elite Aviation bought a jet from gulfstreampreowned.com after a virtual inspection using 360-degree interactive video technology from Interactive Pictures Corporation (ipix.com).

As technology evolves, we will see far greater functionality—especially as wireless applications protocols (WAPs) become commonplace and wireless devices like cellular telephones and personal digital assistants (PDAs) are connected to the Net. United Parcel Service tracking is now possible on a Palm VII. The music industry will be reshaped by emusic.com, mp3.com, and others. Television will be altered when new initiatives such as replayTV, which records specified shows on a hard disk, are more widely adopted. Changing functionality will make dot-com operations appealing to a broad range of companies and customers.

Offering Personalized Interactions

Can we make each customer feel unique on the Net? The appeal of the Net lies in its personalization potential. Customers want to be connected to other customers (C2C interactions) and appreciate personal business-to-customer (B2C) linkages. We see this in popular sites such as My Yahoo!, My Schwab, and My Dell. The challenge is to encourage each visitor to establish a Web-based personal identity without invading privacy. Amazon.com shot into prominence early with its personalized recommendations. Now, many consumer sites incorporate personalization of some kind.

Personalization will become increasingly important as more devices connect to the Net: Think about automobiles and cellular phones connected to the Net (D2D interactions). Significant opportunities and challenges await those who design operating infrastructures that support virtual extensions of the customer.

Streamlining Transactions

The power of the infrastructure lies in its simplicity and efficiency. Increasingly, the winners will be differentiated by their ability to execute streamlined transactions: Amazon pioneered and patented one-click settings—an important differentiator in its bid to establish supremacy. A single, secure way for customers to sign in to multiple Internet sites using one member name and password, Microsoft Passport (passport.com) streamlines processes and delivers personalized value. SAP is creating many modules to port business processes to the Web (mySAP.com).

Consider FedEx, which gave customers immediate access to transactions and delivery status. Dell took it one step further and allowed its customers to see the status of their custom-built machine at every stage of the cycle. Now car manufacturers want to adopt similar functionality to streamline operations. Indeed, for B2B activities, streamlined transactions and cross-sharing of information become central as the firms strive for radical improvements in efficiency. The weaknesses in legacy operations will be exposed in this arena. For instance, data updates should be on a near-continuous basis—especially when selling time-sensitive perishables like airline or concert tickets. Similarly, Internet-only banks, such as wingspan.com, must substantiate their claims of making 60-second mortgage decisions without increasing the banks’ financial exposure. Product configurators for personal computers and cars, for example, must be linked to the production-planning system so that firms can accurately provide delivery dates and prices.

Streamlined operations require a reliable infrastructure. Commerce in the last century has been facilitated by the increased reliability of telephone and telecommunications (think about the reliability of telephones and ATMs) and logistics (FedEx, UPS, and rail carriers have contributed to modern supply chains). Reliability plays a key role in enhancing customer confidence: When sites like E*TRADE and Schwab—which account for an increasing share of stock market trading—are offline, they weaken not only their customers’ confidence but also cast doubt on the dot-com movement.17 As more devices connect to the Net and as more functionality is processed through the Net, reliability will emerge as a major catalyst for Net-based business and a key differentiator for individual companies.

Ensuring Privacy

“Will my transactions be secure? Will my information be safeguarded?” The idea behind “pragmatic privacy” is to convince customers that their privacy will be safeguarded and used only for the purpose of delivering superior value to them.

Privacy emerges as a major inhibitor because customers still are not comfortable with electronic transactions. Credit-card companies have played an important role in offering the same level of protection on the Web as in the physical space, and the browser software companies (Microsoft, Netscape) have incorporated critical safety features into their latest software. Demonstrating the power of various encryption protocols in ways that customers understand will go a long way, but security is more about consumer perception than technical features or protocols per se. Companies like GE are embracing leading security encryption protocols—for example, the RSA Keon AdvancePublic Key Infrastructure software for digital certification (rsasecurity.com). Others are adopting Verisign (verisign.com) or digital original certificates, such as eOriginal, which are created for various applications (eoriginal.com).

Privacy is closely related to security. Customers become concerned about privacy18 on the Net, due in part to the proliferation of software cookies that help Web sites learn about visitors such as DoubleClick (doubleclick.com) and Firefly Passport (firefly.net). These companies have gone out of their way to make customers feel comfortable about their safeguards to privacy. But the real responsibility lies with the companies that use these software cookies. Sites like GM OnStar (onstar.com) or GE (ge.com) explicitly state how they plan to deal with privacy issues, and some audit firms are also beginning to offer services as trusted third-party guarantors of how companies safeguard customer data. Being forthright with customers about privacy will go a long way in enhancing use of the Net.

The Bottom Line: Digital infrastructure should be designed and deployed to enhance customer value propositions. Design the infrastructure so that dot-com operations make it easier for customers to do business without sacrificing customer trust about reliability, security, and privacy. Straddle physical and digital spaces with relevant linkages to partners and alliances to offer a seamless and effective way for conducting the business.

5. Is Your Management Team Aligned for the Dot-Com Agenda?

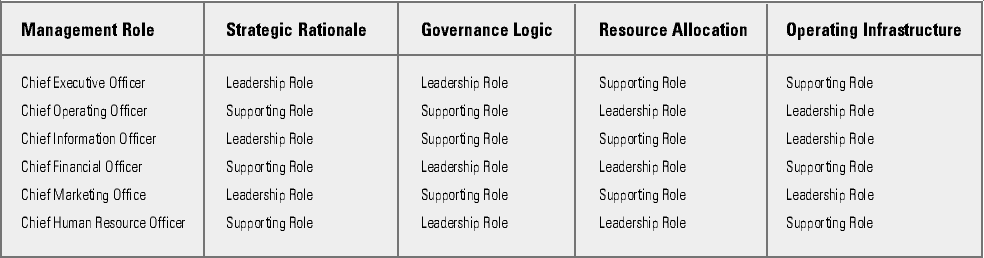

Who leads the corporation to the dot-com world? Is this an opportunity for the senior IT manager to earn the right to become a member of top management? Or is it the marketing manager who articulates how the customer value propositions can be redefined? What roles should the CEO and COO play? Articulating the roles of key members of the management team is central in shaping the strategy of the dot-com operations.

Many companies treat their dot-com operations as a project: certain boards of directors feel relatively comfortable delegating responsibility for carrying out the dot-com “project.” Some see this as an extension of technology-led business initiatives. The words of a frustrated manager capture it best: “The board seems to think that this is like implementing SAP—fund it, delegate it, and ensure that we do not hear about it until it is implemented. This is far different from SAP; we are not just trying to automate and integrate our business processes in a standardized way; we are trying to create new value propositions for customers… and we can’t manage it like another project—decoupled from serious discussions and fundamental choices and commitment from the board.”

The dot-com operations require a pattern of leadership alignment that differs greatly from other business transformation activities. Even business reengi-neering efforts billed as major transformational projects pale in comparison to the tasks and challenges pertaining to the dot-com operations. This is because most reengineering projects—despite claims to the contrary—focus on rectifying weaknesses in the current business models. Very few companies have truly created or redefined their business for the wired, digital world. In contrast, the dot-com world is about value creation. It involves strategic challenges of business creation; important governance issues of organizational structure; and new avenues of financing, changes in operating infrastructure, external relationships, and patterns of resource deployments.

I can’t emphasize enough the importance of senior management alignment in mobilizing the organization to recognize and respond to the dot-com world. Ask each key member of your management team to identify who plays the leadership and supporting roles for the four preceding questions. Such an exercise may help the managers recognize and accept that mobilizing the organization is a team issue and that everyone plays complementary roles. Without overly stereotyping management roles, such a table—only an illustrative approach shown here—can be helpful in orchestrating a constructive dialog within the management team.

If the management team is not in sync, it is easy for the dot-com agenda to be hijacked by one or two members reflecting a partisan, parochial perspective. Every company needs a champion to get started, but it needs more than one champion to succeed. It is encouraging to see many leading companies already embracing the dot-com world. But it is more than Web sites; more than promises to consumers. It is more than merely grafting the Web on as part of business strategy; more than paying lip service to the projects that deal with electronic commerce. It is a serious challenge with profound opportunities and threats to the status quo.

Succeeding in the Dot-Com World

New companies with an Internet focus have grabbed the headlines. Employees and stockholders of these startups have reaped the benefits of new wealth. At the same time, stalwarts like Jack Welch of GE, Jack Smith of GM, and Harvey Golub of American Express have unleashed creative energies within their corporations to develop dot-com visions.19 Some have recognized the value of the Net for B2B transactions, whereas others have focused on B2C transactions. And as new devices emerge and become part of the critical backbone for dot-com operations, every company will need to develop a strategy for the dot-com world. Ultimately, business strategy will be dot-com strategy.

Andy Grove wrote a book titled Only the Paranoid Survive.20 He wrote it before the onslaught of the Net. But his thesis is apt for anyone thinking about dot-com business. We are in the midst of major shifts: Traditional logic, so fundamental to the industrial revolution, is challenged every day by the possibilities of the dot-com world. Well-understood sources of value creation through tangible, physical assets are being replaced by newfound sources through digital assets and networks of relationships. Every market—from agriculture to automobiles to financial services, entertainment, and healthcare—is affected by interactive technology. New entrants are crafting powerful new business models and rewriting the rules of competition. Established companies urgently need to embrace the dot-com agenda; failing this, they will be left behind. They need to blend their traditional and dot-com operations while confronting the challenge of brain drain as their top talent jumps ship for other dot-com operations. The game is far from over, and we will see powerful transformations as companies embrace the Net and craft innovative strategies that successfully blend physical and digital infrastructures. It’s up to managers to take the necessary actions to align their visions to the dot-com world.

While it is too early to declare the leading corporations of the Industrial Age to be the dinosaurs of the digital era, clearly they face daunting challenges.

References

1. For example, see:

M. Cusumano and D. Yoffie, Competing on Internet Time: Lessons from Netscape and Its Battle with Microsoft (New York: Free Press, 1998).

2. M. Porter, Competitive Strategy (New York: Free Press, 1980).

3. M. Dell, Direct from Dell (New York: Harper Business, 1999).

4. Personalization and dynamic customization are important avenues for redefined customer interactions in the post-industrial world. See:

N. Venkatraman and J.C. Henderson, “Real Strategies for Virtual Organizing,” Sloan Management Review, volume 40, Fall 1998, pp. 33–48. See also:

D. Peppers and M. Rogers, Enterprise One to One: Tools for Competing in the Interactive Age (New York: Currency Doubleday, 1997).

5. The latest version of Palm Computing’s Palm VII has infrared wireless capability to access the Net, and a variety of services and accessories will support this platform.

6. For a broad overview, see:

N. Negroponte, Being Digital (New York: Knopf, 1995). For up-to-date views, see: nicholas.www.media.mit.edu/people/nicholas/. See also:

N. Gershenfeld, When Things Start to Think (New York: Henry Holt, 1999); and also see Gershenfeld’s Web site: www.media.mit.edu/ttt.

7. For an elaboration of this view, see:

G. Hamel and J. Sampler, “The E-Corporation,” Fortune, 7 December 1998, pp. 80–92; and

G. Hamel, “Bringing the Silicon Valley Inside,” Harvard Business Review, volume 77, September–October 1999, pp. 70–84.

8. For a good general discussion of the role of experimentation, see several articles in the fortieth anniversary issue of Sloan Management Review. In particular, see:

C.C. Markides, “A Dynamic View of Strategy,” Sloan Management Review, volume 40, Spring 1999, pp. 55–63;

E.D. Beinhocker, “Robust Adaptive Strategies,” Sloan Management Review, volume 40, Spring 1999, pp. 95–106; and

P.J. Williamson, “Strategy as Options on the Future,” Sloan Management Review, volume 40, Spring 1999, pp. 117–126.

9. Miguel Helft, “Wal-Mart Teams Up with Accel,” Industry Standard, 6 January 2000 (www.thestandard.com/article/display/0,1151,8649,00.html).

See also: www.accel.com/news.

10. J.T. Chambers, “The New Economy Is the Internet Economy,” white paper (San Jose, California: Cisco Systems, 1998); and see: http://www.cisco.com/warp/public/750/johnchambers/internet_economy/.

11. See www.intel.com for speeches by Andy Grove and other Intel senior managers.

12. Alex Lash, “A New Strategy for MSN. Again,” Industry Standard, 27 September 1999 (www.thestandard.com/article/display/0,1151,6571,00.html).

13. For a detailed discussion on the role of financial markets in disciplining decisions, see:

M. Amram and N. Kulatilaka, “Disciplined Decisions: Aligning Strategy with Financial Markets,” Harvard Business Review, volume 77, January–February 1999, pp. 95–104. See also:

M. Amram and N. Kulatilaka, Real Options: Managing Strategic Investments in an Uncertain World (Boston: Harvard Business School Press, 1999).

14. Real options have emerged as a powerful approach for dealing with resource allocations under uncertainty. See:

N. Kulatilaka and N. Venkatraman, Real Options in the Digital Economy (Financial Times Mastering Management Series, September 1999); also see: www.real-options.com;

K. Leslie and M. Michaels, “The Real Power of Real Options,” McKinsey Quarterly, number 3, 1997, pp. 4–22; and www.mckinseyquarterly.com.

15. See, for example, Kevin Kelly’s Wired magazine columns; and

K. Kelly, New Rules for New Economy (New York: Viking Books, 1998). For discussions on the information economy, see:

C. Shapiro and H. Varian, Information Rules (Boston: Harvard Business School Press, 1999).

16. New business magazines, such as Business 2.0 (www.business2.com), deal with the creation of business models for the new economy. See also: Wired (www.wired.com); and

Fast Company (www.fastcompany.com).

17. This is evident in the volatility of the stocks of those dot-com companies whose sites have experienced outages.

18. See, for example:

A. Cavoukian and D. Tapscott, Who Knows: Safeguarding Your Privacy in a Networked World (New York: McGraw-Hill, 1997).

19. See, for example:

E. Brown, “Big Business Meets the e-World,” Fortune, volume 140, 8 November 1999, pp. 88–98. For articles dealing with how established companies are striving to respond to the dot-com agenda, also visit

Fortune (www.fortune.com); and

The Economist (www.economist.com).

20. A.S. Grove, Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company (New York: Random, 1996).

Comment (1)

Joe Kramer